WHY GIVE

Mission

Our mission at YouthPower365 is to inspire, educate and empower youth and families from early childhood to college and career readiness..

Impact

By supporting YouthPower365, you help us provide high-quality extended learning opportunities to more than 4,000 youth in Eagle County. To keep our programs affordable and accessible, less than 2% of our revenue comes from fees. This means 98% of our revenue to serve youth comes from generous donors like you!

INCENTIVES TO GIVE

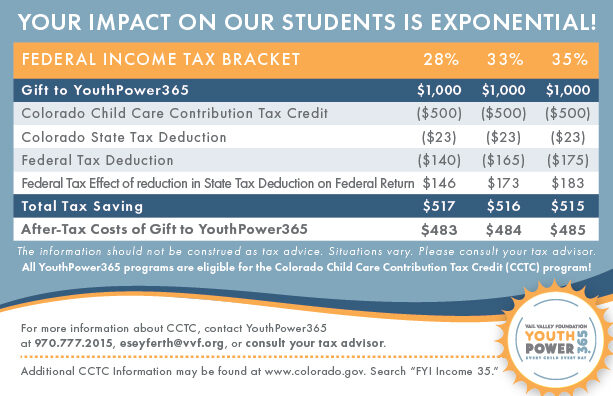

Colorado Child Care Contribution Tax Credit (CCTC)

Supporters of the Vail Valley Foundation’s YouthPower365 who pay Colorado state income taxes may qualify for an income tax credit up to 50% of a contribution by using the Colorado Child Care Contribution Tax Credit (CCTC), in addition to regular state and federal income tax deductions.

CCTC Program Guidelines

-

- 50% of your donation amount will apply to your tax credit

- Credit allowed cannot exceed $100,000 or your tax liability for the year

- Credits may be carried forward for up to five years

- Credit is not valid for stock transfers or in-kind donations, or when benefits are received

- You may claim 100% of the total tax credits earned through contributions made, plus remaining credits from previous years.

- Credit is applicable for donations made to all YouthPower365 programs supporting Eagle County youth from early childhood to age 18.

- All YouthPower365 programs from early childhood through age 18 are eligible for the Colorado Child Care Contribution Tax Credit (CCTC) program!

If you would like to receive a Colorado Child Care Contribution Tax Credit (CCTC) for this gift, please indicate your preference in the appropriate field when completing your donation.

Contact Euginnia Seyferth at 970.777.2015 or eseyferth@vvf.org for further information about ways to support YouthPower365.